Downsizing your home for retirement

From 1 July 2018, eligible people who sell their main residence may contribute up to $300,000 of the sale proceeds to super without being constrained the usual restrictions that otherwise apply to contributions, including age limits and contribution caps

Contributions made to super under this arrangement are referred to as ‘downsizer contributions’ and are subject to specific rules. Downsizer contributions are treated separately to concessional and non-concessional contributions.

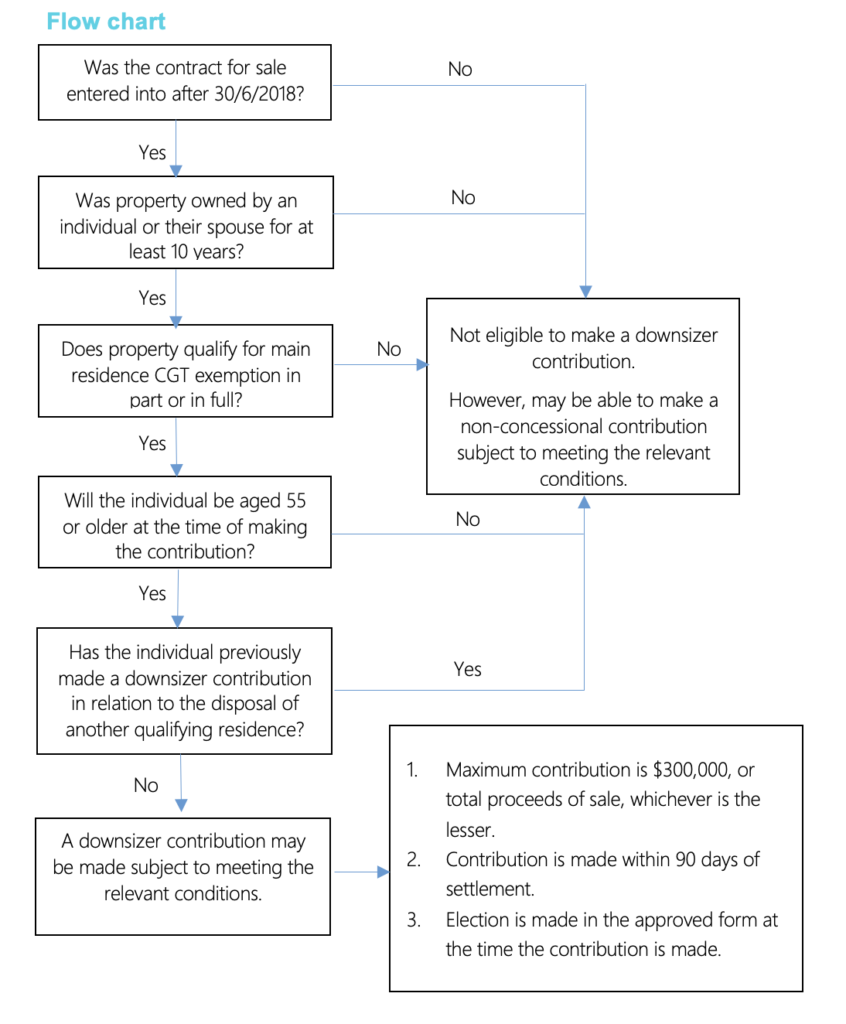

To be eligible to make downsizer contributions, several conditions need to be met, including:

The person has not previously made a downsizer contribution

To qualify as a downsizer contribution, the sale proceeds from which the contribution is to be made must be in respect of the sale of a property that has, at some time during its ownership, qualified for a capital gains tax exemption as the person’s, or their spouse’s main residence.

Therefore, the sale proceeds from the sale of a commercial property, or an investment property that has never qualified for the main residence capital gains tax exemption, do not qualify as a downsizer contribution.

Furthermore, a qualifying residence does not include a houseboat, caravan, or mobile home.

Making a downsizer contribution is contingent upon selling a qualifying residence. However, there is no requirement that a replacement residence must be purchased. For example, a person selling their home and planning to rent a property, relocating to a retirement village or aged care facility, or moving in with family, may still make a downsizer contribution.

A downsizer contribution will be treated as part of the contributor’s tax-free component of their superannuation. Therefore, it will not be subject to tax at the time the contribution is made to the super fund.

As downsizer contributions are not treated as non-concessional contributions, the restrictions applying to non-concessional contributions, including an age limit and total superannuation balance, do not apply.

Downsizer contributions count towards a person’s total superannuation balance. This may impact on their ability to making future non-concessional contributions and receive other Government benefits such as the Government co-contribution and a tax offset for contributions they may make for an eligible spouse.

The super reforms introduced from 1 July 2017 restrict the amount that a person may transfer to a super income stream or pension. This is known as the transfer balance cap. The transfer balance cap is currently $1.9m.

Consequently, even though a person can make a downsizer contribution, the contribution may not be able to the transferred to a pension account where the person has already exhausted their transfer balance cap. While the downsizer contribution remains in a super accumulation account, the investment earnings that accrue on the contribution will be taxed within the super fund at a rate of 15%. This contrasts with the retirement phase where the investment earnings on super benefits that are supporting an income stream or pension are exempt from tax at the fund level.

Furthermore, investment earnings that accrue on an accumulation account form part of the fund member’s taxable component of their benefit. This may have taxation implications where an individual’s superannuation benefit, on their death, is likely to pass to a ‘non-tax dependent’ such as an adult child of the deceased member.

By contrast, if the downsizer contributions can be applied to a retirement phase pension, the investment earnings that accrue are exempt from tax and form part of the member’s tax-free component.

A person’s main residence is generally exempt from the assets and income test when assessing entitlement for Social Security and Department of Veterans Affairs benefits, including the age pension or service pension.

However, selling the main residence and depositing the surplus sales proceed to a bank account, allocating to other investments, or making a downsizer contribution to super may result in amounts that have previously been exempt from the assets and income tests now being assessed under these tests. This may result in the loss of, or a reduction in the amount of pension being paid.

When the main residence is sold and the proceeds are to be applied to the purchase of a new main residence, that portion of the sales proceeds to be applied to the new purchase may continue to be exempt from the assets test for a period (generally up to 24 months). The amount to be applied to the purchase of the new home will however be included as deemed income, using the lower deeming rate, under the income test, until such time as the new home is acquired.

Fred and Francis are aged 68 and 66 respectively. They have owned their family home for 12 years however for the first 3 years of their ownership, it was rented. They list their home for sale in May 2022 and enter a contract to sell the home for $900,000 in July 2022.

They are planning to buy an apartment for $500,000. The surplus arising from the sale of their main residence is $400,000. They could each make a downsizer contribution of $200,000, or any other combination, subject to a maximum of $300,000 per person.

If Fred and Francis are receiving an age pension, the surplus proceeds from the sale of their main residence ($400,000) will be treated as an assessable asset and will result on their age pension reducing or ceasing to be payable, depending on their overall financial position.

If you would like to discuss your options, we encourage you to simply request a call and we will reach out as soon as possible.

Alternatively, if you would prefer to arrange a call at a time convenient for you, click here.

By providing your details you give consent to being contacted and for those details to be stored for communications, contact, marketing and relevant updates.

We do not spam or send regular emails. We only provide carefully curated updates and communications. By subscribing you give consent for Dumont to collect and store your details for communications of articles, contact, marketing and relevant updates.

Dumont Wealth delivers quality and transparent advice to all Australians. We do this by providing holistic strategies tailored to each individual’s needs and circumstances.

© 2025 Dumont Wealth Pty Ltd

Business and Licensee Information: Authorised Representative No. 1272643. Dumont Wealth Pty Ltd. Corporate Authorised Representative No. 1308337. Licensed by Alliance Wealth Pty Ltd, ABN 93 161 647 007, AFSL No. 449221.